In our previous post, we challenged the ERP SI selection process to hold all stakeholders—customers, ERP vendors, and SI partners—accountable for their role in achieving a successful match. Yet many customers tend to focus more on the SI’s sales team than their delivery team. The real challenge is uncovering the gap between perception and reality—a gap that often doesn’t emerge until the project is underway, when correcting course becomes far more difficult and expensive. In this article, we shift the spotlight to what truly matters: how to evaluate the SI delivery team beneath the polished surface to ensure they can drive meaningful outcomes.

Revisiting SI Selection Process

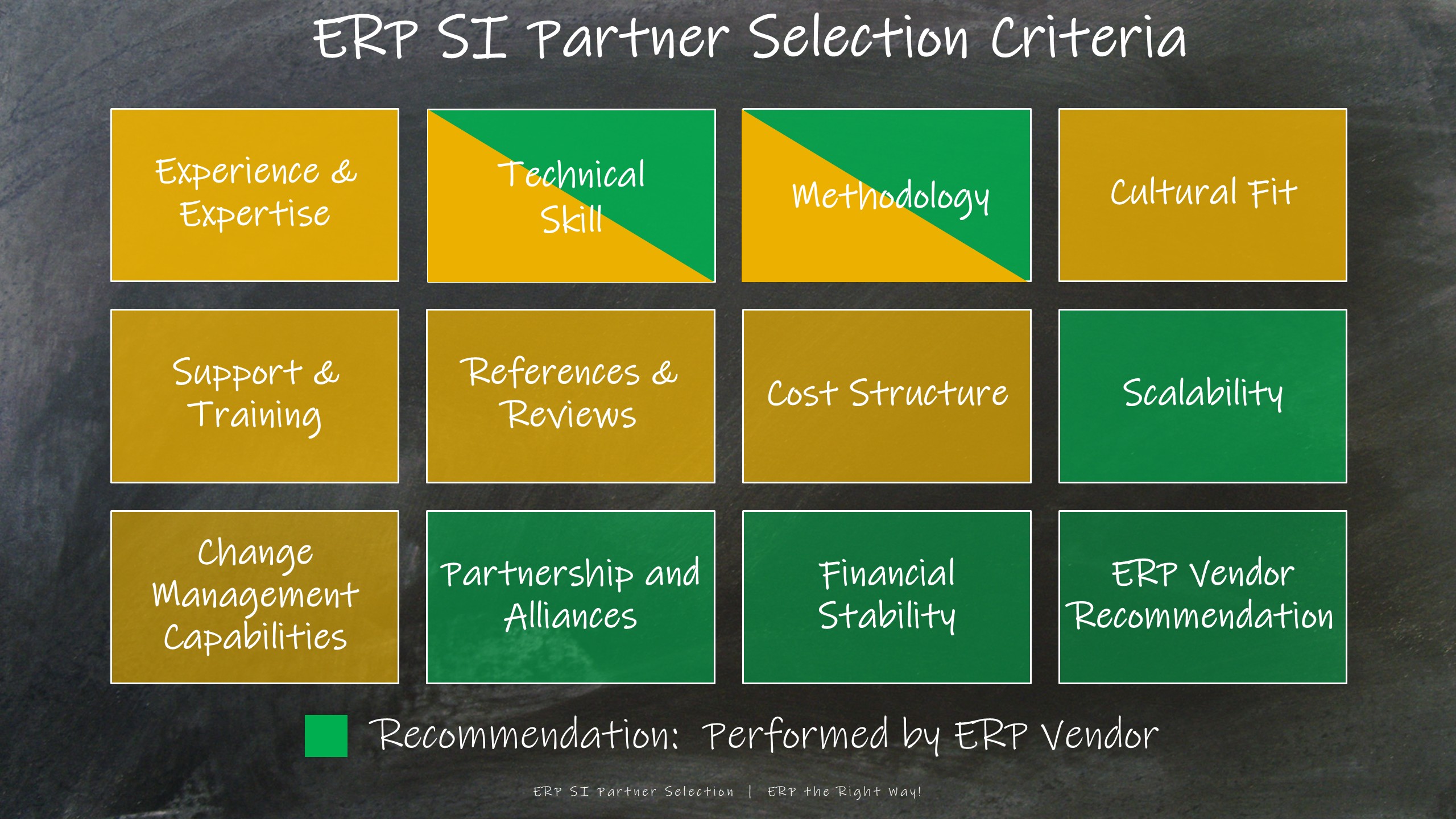

A key improvement I recommend is delegating obvious evaluation criteria—like scalability and financial stability—to the ERP vendor. It’s time for ERP vendors to move beyond passive partner listings and take real accountability for the ecosystem they promote. By shifting part of the evaluation workload to the ERP vendor —with a trust-but-verify mindset—the customer can reduce their effort by 30–45%. That’s nearly one-third to almost half the traditional work and cost, with minimal downside and faster momentum.

A competent ERP vendor should maintain documented evaluations of their SI network members. To become a certified or preferred partner, each SI is typically required to provide tangible evidence of their capabilities and delivery history.

Tip: If your ERP vendor won’t share partner performance data, consider that a red flag worth digging into.

Beyond the Sales Pitch: What to Really Look For in a SI

The goal here isn’t to rehash every possible evaluation criterion a customer might use when assessing an SI. Instead, I want to zero in on the attributes that often get overlooked or are only superficially vetted. To help with this, I’ve created a simple Excel-based evaluation tool to guide the process.

Following is a summary of the spreadsheet:

The tool can be downloaded here

Before you do, I encourage you to review the commentary I’ve provided below. It offers deeper insight into how the model works—and, more importantly, the key drivers and evaluation logic behind it. This background will help you get the most value from the tool and apply it effectively to your ERP SI Partner evaluations.

Why Evaluate SI Delivery and SI Management Separately?

- Different Teams, Different Priorities

Most SIs operate with distinct teams for sales & executive leadership versus project delivery. Don’t assume that the context, needs, or expectations the customer communicate during pre-sales will carry over to the delivery team. In fact, the larger the SI, the greater the disconnect risk. The customer should assess both perspectives independently to gain a realistic view of the SI’s actual capabilities. - Delivery Team Drives Success

Let’s be blunt: it’s not the sales team that will be accountable for your ERP go-live. It’s the delivery team—your assigned Project Manager, Functional Leads, and Technical Architects—who ultimately determine success or failure. Forrester’s ERP SI Wave echoes this view, emphasizing delivery competency and customer outcomes over branding or market presence [12]. So, shouldn’t more of your evaluation effort be spent on the team that’s actually doing the work? - Misplaced Value in the ERP Ecosystem

The ERP market values emerging product features, polished project deliverables and cheaper consultants over realized business results in production. But here’s the truth: decisions—not documents—move ERP projects forward. True value is delivered by experienced consultants who can lead, adapt, and solve—not by the sales team that won the contract [14].

The Doers – SI Delivery Team

The traditional approach is to focus mostly on the SI’s sales and executive team—then eventually get around to a” meet & greet” with the SI’s delivery team at project kickoff. This approach is counterintuitive and undermines delivery assurance. The sales and exec teams can tell a great story, but if the SI doesn’t have the actual resources to execute that story, then what does it matter?

More time and effort should be spent evaluating the SI Delivery team members. It may feel like a radical departure from the norm, but I’m convinced: rocking the boat on the front-end is far better than getting rocked during the implementation.

Given the realities of time and resource constraints, customers are unlikely to formally evaluate every consultant proposed by SI. Instead, focus your vetting efforts on the most critical roles, the ones that have the greatest impact on delivery success:

- Project Leader

- Technical Leads (for Extensions and Data Conversions)

- Functional Leads (for each major business area—e.g., HR, Financials, Supply Chain, and Analytics/Reporting)

These roles drive architecture, decision-making, and team execution. Ensuring the right talent is in place here sets the tone for the entire project [9].

In my experience, cultural fit is often treated as a checkbox, based more on interactions with the SI sales team and generic value statements than a structured evaluation. Interviewing the actual consultants offers far deeper insight. Considering customers often spend up to 2–3x the ERP license on implementation, this small investment can reveal potential cultural misalignments—especially if the right questions are asked.

Most of these questions are designed to gauge self-awareness. It’s critical to engage SI consultants who understand both their strengths and their limits. Equally important, their personal goals should align—at least in part—with the customer’s ERP objectives. Finally, while methodologies provide structure, it’s the consultants who bring flexibility and potential to truly drive success.

The Supporters – SI Sales & Exec Management

My point of view, the SI sales and executive team supports the SI delivery team and provides the framework, resources and partnership for mutual success. There are certain delivery aspects that are directly managed by the SI sales and executive team. Following are the key areas that the customer should evaluate as part of their overall assessment.

Billing should be based on Solution Delivery & Validation, not Documentation.

I believe in a simple principle: an honest day’s work deserves an honest day’s pay. But in ERP, it goes deeper—customers pay for results, not just activity. At the start of an ERP implementation, the customer is making a strategic investment in the SI Partner. That investment isn’t for effort alone, it’s for a working, production-ready business solution that meets the agreed-upon scope.

In order to ensure that the above principles are encouraged, following is a simple, recommended approach that customers should target in their negotiations with potential SIs.

ERP Iteration Milestone Table (Minimum Achievement by Iteration)

| Activity | Iteration 1 (CRP1) | Iteration 2 (CRP2) | Iteration 3 (UAT) |

| Configuration | 30% – foundational config complete | 75% – major processes configured | 100% – final configuration locked |

| Data Conversion | 40% – partial conversion for key objects | 80% – full volume conversion with gaps | 100% – full conversion with reconciliations |

| Testing | 35% – basic scenario walkthroughs | 75% – integrated process testing | 100% – end-to-end UAT complete |

| Training | 30% – early SME awareness and job aid drafts | 75% – SME & key user enablement | 100% – role-based end-user training complete |

Quality Can be a Significant Hidden Cost

“One the most overlooked, untracked hidden costs of an ERP implementation is quality”.

Two schools of thought on solution quality. Either the SI is proactive or reactive. If the entire solution is not validated until UAT, then the SI is reactive. The cost of errors grows exponentially over time: Quality assurance professionals often cite the rule that the later a defect is found, the more it costs to fix. IBM has quantified this: a bug caught just before go-live can cost 6× more to remediate than if it had been fixed during design.

Don’t forget the standard Project Management constraints. Quality is usually the first area of compromise.

Allow me to share some key points:

| Vagueness in Quality Definitions | Statement of Work (SOW) often use terms like “industry standard,” “acceptable quality,” or “best practices” without concrete, measurable definitions [7,10]. These vague clauses offer little enforceability when deliverables fall short of business needs but technically meet the letter of the agreement. |

| Risk Shift via Sign-Off | When deliverables are presented for review, the onus is placed on the customer to identify defects or misalignment. Once signed off, the SI may feel they are completely absolved. |

| Quality Assurance Loopholes | Many SIs intentionally leave quality provisions high-level, knowing the enforcement window is narrow. If quality expectations are not defined early and enforced throughout, the customer absorbs rework costs and timeline impacts later. |

Tip: When SI project margins are tight or resources are substituted during the implementation, quality can be the first area to suffer. Most customers underestimate just how much quality impacts business value realization. Do not assume that Fixed Price SOWs will shift all the risks to the SI. I’ll admit— I grade SIs more strictly than the customer. But given their experience, SIs should be held to a higher standard.

The following are best practice recommendations that customers should require SIs to support to ensure quality does not degrade during the ERP implementation

- Insist on explicit quality metrics (e.g., defect density, acceptance criteria by process, review sign-off thresholds).

- Require test evidence and knowledge transfer outcomes to be part of quality deliverables.

- SI payment eligibility should include satisfying quality metrics.

Best Practice – SI Delivery Team SOW Sign-off

Requiring the SI’s delivery team to review and sign off on the SOW can result in ERP implementation cost savings of 5–10% [6], based on the following drivers:

| Category | Estimated Cost Avoidance | How It’s Realized |

| Avoided Rework & Change Orders | 3–5% | Clarifying scope early reduces surprises and midstream changes [8]. |

| Improved Estimation Accuracy | 1–2% | Delivery team catches impractical timelines or under-scoped tasks. |

| Reduced Onboarding/Context Gaps | 0.5–1% | Fewer delays due to misalignment between what was sold and what’s delivered. |

| Fewer Disputes Over Deliverables | 0.5–1.5% | Clear expectations up front reduce friction and time spent managing misunderstandings. |

I have observed this “disconnect” with both Tier 1 and Tier 2 SI Partners. Therefore, I would recommend customers to request this additional assurance to ensure alignment across the SI.

Outsourcing Data Conversion with SI Offshore

Data conversion is not a recurring competency—ideally, it’s a one-time effort with each ERP implementation, typically once every 8–10 years. Because of this, most customers are understandably hesitant to make a major investment in this area. As long as the work is done competently and cost-effectively, that’s considered “good enough.”

Unfortunately, these dynamics are exactly why data conversion is chronically underestimated in ERP implementations [15]. It’s also a key reason why many SI Partners push this work offshore—not necessarily as a quality move, but as a cost-control strategy. Let’s call it what it is: a budget-driven decision, not a value-driven one.

Data conversion isn’t just a technical exercise — it’s a strategic enabler of ERP success. And yet, it remains one of the most underestimated and underfunded workstreams in most implementations. Here’s why:

- Strategic Impact Is Invisible Until It’s Too Late

Most teams don’t realize that dirty, incomplete, or misaligned data will directly undermine go-live stability, reporting accuracy, compliance, and user trust — until those issues surface in production. - Both the Customer and SI Undervalue Its Role

Many SIs outsource data conversion offshore as a “technical task,” disconnected from business validation. At the same time, customers assume the SI “has it covered” — leading to critical ownership gaps and mismatched expectations. - Tools Are Less Important Than Ownership and Reconciliation

Tools can automate loading and formatting — but success depends on business rule alignment, reconciliation logic, and data ownership. Without a clear owner, robust testing, and multiple trial runs, even the best tooling will fall short.

Beware the Integration Mirage

Most SI Partners default to basic point integrations in order to reduce development time and cost. Unfortunately, SOW documents rarely clarify the full functional scope of these integrations, or the responsibilities assigned to the customer.

In reality, these one-way data pushes often lead to fragmented processes:

- Manual configuration syncs across systems

- Duplicate workflow definitions

- Redundant security provisioning

- Limited visibility into transaction status across modules

Over time, these inefficiencies generate a “hidden tax” on the customer’s organization—absorbed through rework, data inconsistencies, and increased FTE time spent reconciling issues.

These recurring burdens don’t just create friction—they accumulate significant cost over the 10+ year lifespan of the ERP system [11]. That’s why integration quality and completeness must be evaluated as a long-term investment, not a short-term savings play.

Here is a quantified comparison of Point Integration vs. Full Integration over the 10-year life of an ERP system, based on typical industry benchmarks, observed customer outcomes, and ERP implementation experience.

| Category | Point Integration | Full Integration | Notes / Assumptions |

| Initial Development Cost | $50K–$100K per integration | $75K–$150K per integration | Full integration costs more upfront but includes workflow, error handling, auditing, and orchestration. |

| Ongoing Support & Maintenance (10 yrs) | $100K–$200K | $30K–$75K | Point integrations require frequent break/fix cycles due to brittle logic and lack of orchestration. |

| Reconciliation / Manual Workarounds | $250K–$500K+ | $25K–$75K | Due to poor error handling, manual syncs, and increased FTE effort. |

| Risk of Data Errors & Compliance Gaps | High – Up to 5–10x more errors | Low – Proactive validation & full transaction visibility | Errors in tax, payroll, or financial close can trigger audits, fines, or executive concern. |

| Business Impact | Process delays, duplicate entry, low user trust | Streamlined workflows, real-time visibility | Poor user experience erodes adoption and slows transformation. |

| Total Estimated 10-Year TCO (per interface) | $400K–$800K+ | $130K–$300K | Full integration may cost more upfront, but it avoids long-term hidden costs and rework. |

Point integrations cost ~2–3x more over the ERP lifecycle when considering:: manual workarounds; rework due to failure. Ongoing support escalations; and business productivity losses.

Summary

ERP success hinges not just on the software, but on the people who implement it [13]. Customers must look beyond polished sales pitches and thoroughly evaluate the SI delivery team—not just the executives or partner credentials. As the ultimate decision-maker, the customer should (a) leverage all available resources and stakeholder input, (b) understand the diverse perspectives of what “success” looks like, and (c) promote a shared-risk, shared-reward model to align incentives and drive outcomes.

Call to Action

- Insist on Delivery Team SOW Sign-Off

Avoid rework, change orders, and delivery disputes. Brings 5–10% cost savings. [1,6] - Define Quality Up Front and Look for Trouble

Explicit metrics. Review thresholds. Test evidence. Include in payment terms. Yields 3–6% savings by reducing costly late-stage defects. [2] - Elevate Data Conversion to a Strategic Workstream

Focus on ownership, reconciliation logic, and validation—not just tools. Prevents 4–8% of implementation delays and overruns.[3] - Scrutinize Integration Design

Short-term savings from point integrations often turn into long-term liabilities.

If the ERP is meant to integrate your business, don’t let disjointed point solutions weaken its core value. Smart integration design can reduce lifecycle cost by 5–10%.[4] - ERP Vendor Involvement

Most ERP vendors maintain performance data on their SI partners—use it! By delegating the evaluation of self-evident criteria to the ERP vendor, customers can accelerate the SI selection process. However, don’t take recommendations at face value—insist on documented evidence to back them up. Customers can accelerate the SI selection process and reduce effort by 3–5%.[5]

Add it all together, that could be 20% to 40% of Total Implementation Costs that you can spend wiser!

Sources:

- [1] Panorama Consulting, 2023 ERP Report – statistics on budget overruns and causes. https://techtarget.com4439340.fs1.hubspotusercontent-na1.net

- [2] IBM Systems Sciences Institute – “The Rule of 10x”: cost to fix defects grows tenfold at each SDLC stage. Referenced in quality assurance benchmarks.

- [3] Deloitte Risk Advisory – “Data Migration Risks” whitepaper. Highlights underestimated migration as a top-5 delay factor in ERP programs.

- [4] Nucleus Research, “The Real Cost of Poor ERP Integration” – Total Cost of Ownership findings. Also supported by iStart’s “The Hidden Costs of ERP Implementations.”

- [5] Gartner ERP Vendor Scorecards – formal documentation of SI performance benchmarks available to clients. See “Partner Ecosystem Accountability” in ERP strategy reports.

- [6] Logan Consulting (Guy Logan), “Avoid Costly Change Orders in ERP – Tip #1: SOW Review”, proactively identifying potential misalignment by SI and customer.

- [7] SP Singh, “How to Review a Statement of Work – 6 Checkpoints”, ERP best practices for SOW clarity.

- [8] Solutions360, “Who Should Pay for All Those Change Orders?” – addressing change orders during an implementation.

- [9] Deskera, “How ERP Simplifies Project Management “– insight on resource planning, avoiding underutilization and bottlenecks .

- [10] Gartner, “Avoiding Cost Overruns in ERP”, analysts view on hidden risks in SOWs.

- [11] Nucleus Research, “ERP Value Matrix 2023”, analysts view on point vs. full integration argument.

- [12] Forrester, “Forrester Wave on ERP SI Partners”, insight on analysts evaluate SI competency.

- [13] Standish Group, “CHAOS Report”, reinforces why customer due diligence on SI teams matters.

- [14] Constellation Research, “ERP Implementation Trends”, how analysts view outcomes versus activities.

- [15] Deloitte Risk Advisory – “Data Migration Risks” whitepaper. Highlights underestimated migration as a top-5 delay factor in ERP programs.”

Leave a Reply